No Credit Check Loans In South Carolina: An Observational Study

페이지 정보

본문

Lately, the monetary panorama in South Carolina has witnessed a significant rise in the recognition of no credit check loans. These loans, typically marketed as quick and straightforward solutions for people facing monetary difficulties, have become a subject of dialogue among customers, financial specialists, and policymakers. This observational analysis article goals to delve into the characteristics, implications, and client behaviors surrounding no credit check loans in South Carolina.

Understanding No Credit Check Loans

No credit check loans are financial products that permit borrowers to secure funds with out the normal credit assessment that most lenders require. As an alternative of evaluating a borrower’s credit historical past, lenders typically deal with different factors resembling income, employment standing, and bank account data. These loans are usually supplied by payday lenders, online lenders, and some credit score unions, and so they are available various types, together with payday loans, installment loans, and title loans.

The Enchantment of No Credit Check Loans

The first allure of no credit check loans lies of their accessibility. Many individuals in South Carolina might have poor credit score scores due to various causes, together with medical debt, unemployment, or past monetary mismanagement. For these shoppers, conventional loans will be unattainable, making no credit check loans a horny various. These loans are marketed as a fast fix for pressing monetary needs, equivalent to unexpected medical bills, automotive repairs, or utility bills.

Demographic Insights

Observational knowledge signifies that a significant portion of borrowers utilizing no credit check loans in South Carolina belong to lower-income households. Many of these individuals work in sectors with irregular earnings, comparable to retail or service industries, which could make it challenging to fulfill conventional loan requirements. Additionally, the demographic profile of borrowers typically includes younger adults, notably these aged 18 to 34, who might lack established credit histories.

The Borrowing Process

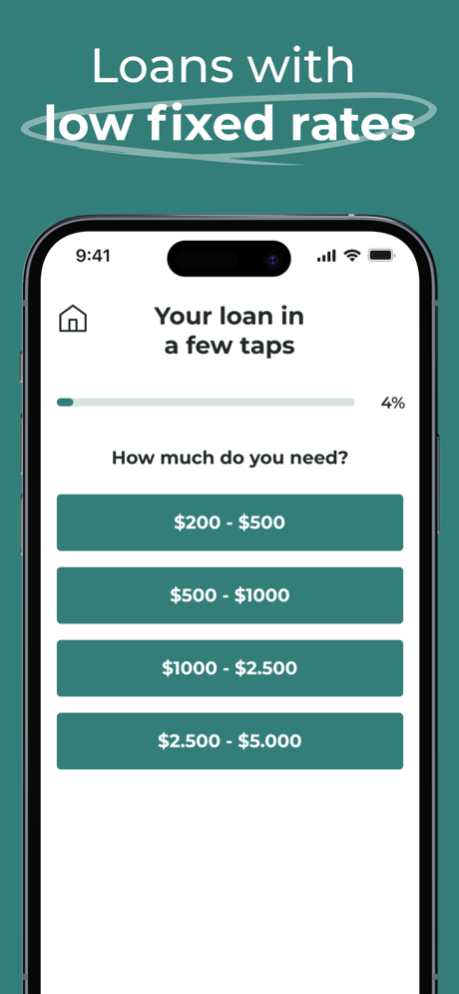

The process of obtaining a no credit check loan is typically easy and expedited. Borrowers can often full applications on-line or in-person, with minimal documentation required. This ease of entry can result in impulsive borrowing, the place people may take out loans without fully understanding the phrases or the potential consequences. Observations reveal that many borrowers don't read the high quality print, resulting in misunderstandings relating to curiosity charges, repayment intervals, and fees.

Curiosity Rates and Fees

One of the vital concerning points of no credit check loans is the excessive-interest charges and charges related to them. In South Carolina, payday loans, for example, can carry annual proportion charges (APRs) exceeding 400%. Such exorbitant rates can trap borrowers in a cycle of debt, the place they're pressured to take out further loans to repay previous ones. Observational studies highlight that many borrowers in South Carolina discover themselves rolling over loans, incurring extra charges, and in the end dealing with monetary distress.

Consumer Habits and Attitudes

Interviews conducted with borrowers reveal a complex relationship with no credit check loans. Whereas many categorical gratitude for the fast monetary relief these loans present, there is also a way of regret concerning the long-term implications. Some borrowers report feeling overwhelmed by the repayment process, resulting in increased stress and 1 month loan no credit checks anxiety. Moreover, a lack of financial literacy plays a big position in client behavior, as many people don't fully understand the implications of high-interest borrowing.

The Regulatory Panorama

The regulatory setting surrounding no credit check loans in South Carolina has been a degree of contention amongst consumer advocates and lawmakers. Whereas some regulations exist to guard borrowers, resembling limits on loan quantities and repayment terms, critics argue that these measures are inadequate. Observational analysis signifies that many borrowers are unaware of their rights and 1 month loan no credit checks protections, leaving them weak to predatory lending practices. Advocacy groups are pushing for stricter rules to ensure honest lending practices and to advertise financial education amongst shoppers.

Alternatives to No Credit Check Loans

In light of the challenges related to no credit check loans, it is important to explore alternative monetary products which will higher serve consumers in South Carolina. Choices resembling credit score unions, group improvement financial institutions (CDFIs), and 1 month loan no credit checks peer-to-peer lending platforms supply more favorable terms and 1 month loan no credit checks lower curiosity rates. Moreover, financial training applications can empower people to make knowledgeable selections and discover budgeting methods to keep away from reliance on excessive-cost loans.

Conclusion

No credit check loans current a double-edged sword for customers in South Carolina. While they supply instant access to funds for these in need, the lengthy-term monetary implications will be detrimental. Observational research highlights the importance of understanding the borrowing process, the associated costs, and the need for regulatory reforms to protect weak shoppers. If you liked this report and you would like to acquire a lot more info relating to 1 month loan no Credit checks kindly check out our own web site. Because the demand for these loans continues to rise, it's essential for policymakers, monetary educators, and community organizations to work collaboratively to advertise responsible lending practices and to offer shoppers with the tools they need to make informed financial decisions. By addressing the foundation causes of monetary insecurity and expanding access to inexpensive credit score choices, South Carolina can foster a healthier monetary ecosystem for all its residents.

- 이전글Private Instagram-Inhalte Öffnen Sicher 25.08.11

- 다음글BK8 – Thiên Đường Cá Cược Trực Tuyến 25.08.11

댓글목록

등록된 댓글이 없습니다.